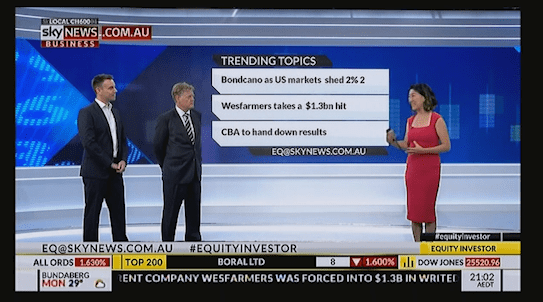

12th February 2020

SBS News with Jessica Amir: CBA reporting season

CBA shares surged to a five year high on the day the bank announced its half year results (12 Feb 2020).

One of our Market Analysts was on on SBS and chatted to Ricardo Gonçalves for more.

What did you make of the results? /highlights?

A phenomenal financial report card - better than the market and Bell Potter expected for the 6-month ending last year. Which is why we saw CBA shares surged 4% higher to a five-year high - $88.16.

Despite the headline result being weaker than the same time last year, its cash net profit after tax (NPAT) hit $4.5 billion - stronger than the $4.3 billion the market expected.

It comes as its interest earned from business lending, mortgages and transactions accounts rose, - offsetting its $83 million bushfire claims. And the bank also maintained its half year dividend of $2.00 (as expected)

Is it a reflection of the banking sector?

Well a can’t speak for the other banks –But for CBA – It looks like they could be in a stronger shape than the major banks - as they’ve already declared their legal penalties and are appear to be on track with remediation. But for today’s result, as CBA the largest of the big four banks – with market size of NAB ANZ combined - it was great to see Loan impairment expenses were mostly steady – So – it’s a good sign as its shows Aussies (their customers) are repaying loans on time.

Today they also highlighted their back to-basics banking approach, and innovative edge –miles ahead of the others.

Challenges ahead?

CEO Matt Comyn today highlighted uncertain economic environment, as well the drought and bushfire impacts.

But – the good news is We know although it is outperforming its peers, we know interest rates are expected to be cut this year, which is why CBA flagged its net interest margin (the money it makes vs pays out) is expected to be weak in the second half of the financial year.

We also think the bank would returning money to shareholders after it made $1.5 billion from selling its asset management business. But it did leave the door open for future “initiatives”.