Can't see the answer you're looking for below? Ask a question here or call our client support team on 1300 786 199.

Conditional orders allow you to pre-set a trade based on triggers you decide without having to consistently monitor the market. You can plan for future market conditions, capitalise on potential trading opportunities and manage downside risk by taking action in real time to manage your portfolio.

All you have to do is set specific conditions on when to buy or sell a share, and when these conditions are met, your order is triggered and sent to market. You can set a condition based on:

- a price - your pre-determined action (buy or sell) will automatically trigger when the share reaches your price.

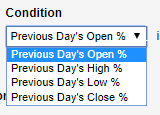

- a percentage increase or decrease - if the stock goes beyond your specified percentage limit (based on the previous day’s open/close/high/low price), action will be triggered.

You can set trigger conditions on equities, interest rate securities, warrants and on a different stock to the one you wish to trade.

You can set a maximum of three conditional orders per stock, up to a total of 50 active conditional orders per trading account and a total of 100 active conditional orders per username across all associated trading accounts.

Our conditional order service is free and you will only pay normal brokerage when your trades are triggered and executed.

Limit price

The stock must meet the price you set before your pre-determined action is triggered.

In the case of a price limit, the condition will automatically be the last traded price.

- If you are using conditional order as a stop loss, select 'less than or equal to' when selling

- If you are using conditional order as a profit trigger, select 'greater than or equal to' when selling

Example:

1. You have bought a stock XYZ at $10.00 and want to sell to limit your loss if the stock price begins to fall.

2. You create a conditional order by setting your trigger price to $9.70, with a sell limit at ‘less than or equal' to $9.50.

3. If the price of XYZ reaches $9.70, your order is triggered and will be placed on the market to sell at no less than $9.50, capping your loss at $0.50 per share.

Trailing percentage price

You can create a conditional order where the trigger price is based on a specific percentage movement in the share price to the previous day's open/high/low/close price. The percentage specified must be numerical, positive and be a whole percentage number.

This trigger price is calculated, then used as a reference point to monitor trade events in the market. Action will be triggered when the stock moves above or below your calculated trigger price.

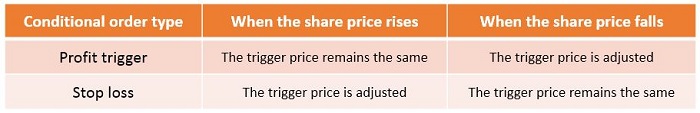

Trailing Stop Loss orders are particularly helpful for you to capture the upside in your investment but be protected from any sharp downturn in price.

Example: Trailing Stop Loss

Our trailing stop loss type conditional order follows a stock share price as it moves upwards, and will result in a Sell order being placed to market when the price falls and reaches the calculated trigger price.

Our trailing stop loss type conditional order is set as a trailing percentage of the previous day's yesterday’s high/low/open/close. The trigger price is recalculated daily and will follow the share price only if it moves up. If the share price falls, the trigger price will be retained.

1. You set a trailing stop loss type conditional order to Sell 1000 AAA shares if the price falls by ‘less than or equal’ to 5% below the previous day’s close. When you enter the order, previous day’s close price is $10.00 so your trailing stop trigger price is $9.50 (i.e. 5% below the previous day’s close price of $10.00).

2. As the AAA share price keeps moving up, your trigger price adjusts accordingly. The stock’s closing price peaks at $15.00 and the calculated trigger price is adjusted to $14.25 (5% below $15.00).

2. As the AAA share price keeps moving up, your trigger price adjusts accordingly. The stock’s closing price peaks at $15.00 and the calculated trigger price is adjusted to $14.25 (5% below $15.00).

3. The AAA stock then begins to fall and closes the day at $14.50. As this price is lower than the previous day’s closing price of $15.00, your calculated trailing stop trigger price is retained and remains at $14.25.

4. The next day, AAA share price continues to fall and reaches $13.00. As the stock price has now crossed the trigger price of $14.25, your Sell conditional order is triggered and placed into market.

Where you specify a limit price, your triggered sell order will sell at this limit price or higher.

For example, the conditions for your trailing stop loss order are met (with the calculated trigger price at $14.25) but you have set a limit price of $14.30. As your trigger price of $14.25 is below your limit price of $14.30, your Sell order will be placed at $14.30.

Volume trigger

You can choose a specified total volume of stock that must be traded for a stock on a given day. This amount cannot be zero or negative. Your order will only go ahead if this specified volume has been met.

The volume includes On Market trades, adjusted for trade cancellations and excludes Off Market trades.

Time trigger

You can choose a start time so the order will not be trigger prior to this time.

Alternatively, you can choose a finish time so the order will not be triggered after this time.

These triggers are independent of each other, you may solely choose a start or a finish time or use both and prevent your conditional orders from triggering during certain periods for example on market open or market close.

Cross Stock trigger

You can set trigger conditions based on a different stock than the one you wish to buy or sell, i.e. if the last traded price for BHP is 'greater than or equal to' $30.65, buy 500 RIO at $2.10.

This is useful when you believe a movement in one stock is closely linked to or will lead to the movement in another stock.

Once trigger conditions are set, you can create your order:

- Choose a stock

- Choose whether to buy or sell

- Choose the quantity you wish to buy or sell

- Choose a limit price – decide on a maximum price to buy or a minimum price to sell your stocks. If your conditional order is triggered but the share price has moved too far above your upper limit price, or too far below your lower limit price, then no order will be placed to market.

Your conditional order only triggers once, i.e. the first time the condition is met.

Please note:

- 'Limit' orders can be placed at any time, but can only be executed when the market is open.

- Your conditional order will only be executed if all of your specified trigger conditions are met.

- If your 'Buy' limit price is placed higher than the current best sell price, the order will execute at the best sell price currently in the market. Likewise, if your 'Sell' limit price is lower than the best buy price, the order will be executed at the best buy price within the market.

To activate conditional orders

- Login to your account, activate conditional orders trading in the 'My account' tab and agree to the T&Cs.

- Once activated, you can click on the Conditional Order icon in the left-hand toolbar.

To track a conditional order

To view all active and historical conditional orders, go to the 'Conditional Orders' section in the 'Orders' tab.

From this page, you can opt to view more details on a specific conditional order, check the status, amend and cancel individual or all active conditional orders.

To amend a conditional order

You can amend or cancel an active conditional order at any time.

- Simply go to the 'Conditional orders' section in the 'Orders' tab where you will see your Open conditional orders

- Find the conditional order you wish to amend and go to 'order details' on the right-hand side

- Here you can view, amend or cancel your active conditional order.

To reset a conditional order

You can save time creating a new conditional order by re-using the same settings as an expired order.

- Simply go to the 'Conditional orders' section in the 'Orders' tab where you will see your conditional order history

- Find the old conditional order you want to reset, then click 'Reset' found under the 'Status' column. The conditional order pad will display with the same pre-filled fields.

- Review all the trigger conditions and order instructions, then click 'Confirm' to create a new conditional order.

If your conditional order has been triggered, you will receive an email and SMS (if you have opted for it). You will receive a notification for the following events:

- Placed, amended or cancelled conditional orders

- Triggered conditional orders

- Rejected triggered conditional orders

- Purged conditional orders

You can also check the status of your conditional orders in the 'Conditional orders' section in the 'Orders' tab in your account.

Please note:

There is no guarantee that a conditional order will be executed following the trigger of all your set conditions. The execution is subject to the successful validation and review by Bell Direct's operations team and may be rejected where the triggered instruction fails to satisfy our requirements or if you have insufficient stocks or funds to fulfil the order. For more details, please refer to the conditional orders T&Cs.

Our conditional order service is FREE.

You will not be charged to place a conditional order and you can amend your active conditional orders as many times as you like at no cost.

Once your triggered conditional order is placed, the standard brokerage fee will apply.

You can specify a trigger expiry date of up to three months. If the condition is not met within the time period you specify, your conditional order will expire.

Please note:

Your Conditional Order may also be purged earlier before the expiry for various reasons including a corporate action on the stock, change of stock code by ASX, at the request of the ASX or any other third party. For more information about this, go to conditional orders T&Cs.

You will receive an email and SMS notifications (if you have opted for this) to inform you of any expired and purged conditional orders.