This article was first published on Australian Financial Review here.

Younger self-managed super fund investors are helping to drive the sector's growth, with the Australian Taxation Office's most recent figures showing a rise in SMSF trustees aged 25 to 34 last year.

The shift is in line with changing working patterns for Millennials, who expect to have a number of different employers over their career. Melinda Howes, general manager superannuation, BT Financial Group, says this has major ramifications for their approach to SMSFs.

"Gone are the days when a young person would start work in the mailroom and spend several decades with one employer. Millennials generally have a more fluid working life and a growing number are using an SMSF to keep track of their super, irrespective of where it comes from over the course of their career, " says Howes.

BT's research shows there is a growing level of financial literacy among Millennials, which means they are more active investors and have more of a desire to take control of their super savings. The latest BT Australian Financial Health Index shows 25 to 34-year-olds are more likely than those aged 55 to 74 to use a formal, documented budget. This proactive approach is likely to change the shape of the SMSF sector over time.

"Younger SMSF trustees will drive demand for greater digital innovation in the sector, as they expect to manage their super in the same way as their everyday banking, social media and household management," says Howes.

Performed well historically

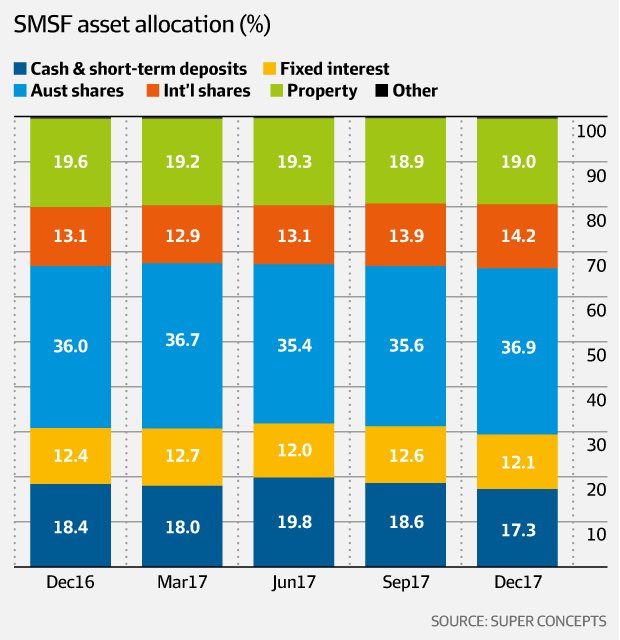

In terms of asset allocation for SMSFs, there was a shift to local and international shares in the last quarter of 2017, according to SuperConcepts. SMSF trustees reduced their exposure to cash and fixed interest in that period.

While it is difficult to compare SMSF performance with APRA-regulated funds given each SMSF has its own investment objectives, advisers suggest SMSFs have performed well historically relative to mainstream funds – although that may not have been the case last year.

As Damian Liddell, a financial adviser with Contrarian Group Financial Planning notes, SMSFs have achieved returns in the low-to mid-teens every year for the last five years. This trend has reversed in the last six months, which he partly attributes to SMSF exposure to infrastructure.

"Look at classic infrastructure companies like Transurban and Sydney Airport. After heading in a constantly upwards direction for the past few years, their share prices look to have topped out," he says.

SMSFs also tend to have large exposures to banks, which underperformed in 2017.

"So, it is likely SMSFs will have underperformed other funds last year," says Greg Einfeld a director of SMSF advice firm Plenty Plus.

ATO figures show there were 596,516 SMSFs at June 30 2017 with total assets of $696 billion, a 12 per cent increase year-on-year. But Einfeld expects this growth to slow for a number of reasons.

"Members with large balances are now reaching the stage where they are drawing down on their pensions and lower contributions caps are limiting the amount people can put into super," he says.

Distinct trends

Nevertheless, Arnie Selvarajah, CEO of Bell Direct, says SMSF trustees still see the value in managing their own retirement outcomes.

He says from an asset allocation perspective, there are some distinct trends between self-directed and advised SMSF investment portfolios. Exchange-traded funds are a good example.

Bell Direct's numbers show advised portfolios hold 19 per cent of their investments in ETFs, versus self-directed portfolios, which hold 7 per cent in these structures.

"This likely indicates more diversification in advised portfolios, that is, ETFs are being used to achieve international and alternative asset class exposure," he says.

The online broker's figures outline the excessive weighting SMSFs place on banks. According to its data, on average, SMSF investment portfolios that receive financial advice have a 47 per cent weighting to financials, a 10 per cent weighting to materials, a 9 per cent exposure to health care and 7 per cent in consumer staples.

Self-directed SMSF portfolios hold 41 per cent of their assets in financial sector stocks, 14 per cent in materials, 8 per cent in health care and 7 per cent in consumer staples.

While markets have climbed around the world in recent years and the memory of the financial crisis of 2007/2008 has receded, SMSF investors are also advised to consider how a serious crash could affect their wealth.

Older and wealthier

"SMSF investors tend to be older and wealthier than those in large super funds, which makes them far more susceptible to sequencing risk," says Milliman's head of fund advisory services, Michael Armitage.

Sequencing risk describes the severe impact a market downturn can have on the value of assets owned by older or newly retired investors. After a correction, they have fewer years to benefit from an eventual market upswing compared to younger investors who are still contributing to their funds.

"As inflation concerns re-enter the market, SMSF investors need to be more aware of the impact unexpected market downturns can have on their retirement savings. Our analysis shows a typical SMSF portfolio has about a one-in-12 chance of experiencing a double-digit drop in the fund's first year, which would strip eight years from a pension," says Armitage.

"This heightened sequencing risk means if an SMSF investor lost 10 per cent of the value of the fund in the first year of retirement, he or she would need to outperform inflation by 5.9 per cent a year for the subsequent 29 years to make up for the impact of the downturn.

"With interest rates still around historic lows, investors will struggle to fund decades in retirement without a strong exposure to growth assets such as equities. However, market downturns and excessive volatility can easily destroy a lifetime of savings if they strike at the wrong time," he says.

Armitage says many SMSF trustees are aware of the effect sequencing risk could have on their portfolios. He says a growing proportion of investors are exploring managed risk strategies, which use derivatives such as futures and options, to retain an exposure to equities while limiting downside risk.

Liddell's advice for super fund trustees in the current investment climate is to make sure the fund is diversified and develop realistic expectations about its return potential.

"Infrastructure returns have been phenomenal over the past five years but returns for the next five years almost certainly won't be as good. It's still worthwhile investing in infrastructure so that you have an overall truly diversified portfolio," says Liddell.

Time consuming

"But think about trading off a bit of the liquidity the listed equities component of the portfolio provides and see if you can get exposure to direct infrastructure assets. Not being listed, they are not as liquid as infrastructure equities, but they will be less volatile," he adds. Investors can go direct by investing in managed funds.

SMSFs can be unexpectedly time consuming given the work involved in asset allocation, administration and reporting. It is important potential trustees understand this before opening an SMSF.

They can also be expensive. Selvarajah estimates the cost of a good SMSF administration solution will be about $1350 a year.

"This includes all accounting, tax and audit fees, and all admin relating to running the fund. On top of this, trustees should consider the one-off costs of initial advice and fund establishment, and the ongoing costs of admin, financial advice, asset allocation and access to research," he says.

It is important for people considering opening an SMSF to ensure they have the skills, time and money to manage the structure properly and comply with regulations.