Premium bonds: A key consideration for investors focused on income

We are often asked by investors why they should pay above par for a bond – what’s known as a premium bond. Why should they buy an XTB today for $110 when they know it will mature at $100?

Let’s say that you have decided to invest in a bond and have three to choose from:

- A Bond: Price $100.00 pays a coupon of 3.0%

- B Bond: Price $99.61 pays a coupon of 2.8%

- C Bond: Price $100.96 pays a coupon of 3.5%

All of the bonds mature in two years, in 2020 at $100. Which one would you choose?

Instinctively, most investors would select either Bond A or Bond B, a bond trading at or below its par or Face Value. However, you may be surprised to discover that the Yield to Maturity for each of these bonds is the same – 3.0%.

Based on yield and coupons alone, how can an investor choose between these three bonds?

Note: Yield to Maturity (YTM) is the key measure for bond returns. It is the ‘total return’ you should receive if you buy the bond today and hold it to maturity. It factors both coupons payments and the face value received at maturity. Find out more about how bond measures are calculated.

Firstly, let’s clarify what premium and discount bonds are

When you buy a bond, especially if you are buying it after issue, it is unlikely you will buy it exactly at par, or Face Value. More often than not, you will buy it for either:

- Less than its Face Value: at a discount; or for

- More than its Face Value: at a premium.

What happens to bond prices over time?

No matter what price a bond is today, unless there is an event of default, bonds will always mature at their Face Value. A bond purchased today for $110 which matures in 3 years’ time will gradually decrease in price until it reaches its Face Value of $100 when it matures in 2021.

A simple way I’ve heard this described is to think of the bond’s maturity date as a magnet: the maturity date magnet pulls the bond premium closer and closer to face value every year.

The current low rate environment

In today’s environment where interest rates have declined over recent years, many of today’s bonds are trading at a premium. Paying above Face Value for a bond can seem counter-intuitive – it may not seem like a good investment on first glance, however there are many sound reasons to consider bonds at a premium.

Bonds trading at a premium provide higher cash flows due to their higher coupon rates. These larger cash flows allow investors to recoup their investment more quickly, and to benefit from an above market rate fixed income stream until the bond matures.

When you buy a bond at a premium, if you are intending to hold that bond to maturity, you know at the outset you will make a capital loss. You are paying more for that bond now than you will get back when it matures.

But this does not mean you are losing money.

When the bond has a high coupon, the additional income from the higher coupon payments can prove very attractive to investors focused on income. Investors know they’ll receive those coupon payments on fixed dates every year whilst they hold the bond. This additional income can make cash flow management a lot simpler.

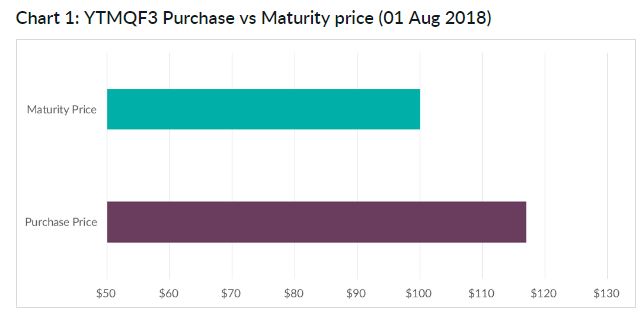

How this works for a $100,000 investment in YTMQF3 – Qantas 7.75% 2022

- The investor has $100,000 to invest and selected YTMQF3 on 01 AUG 18.

- The price of each YTMQF3 unit on that date is $117.95.

- The investor purchases 847 units of YTMQF3 for $99,903.65

- XTBs can only be purchased in whole units, so the investor needs to either round up or round down his initial investment

- At maturity in 2022 the investor receives the Face Value of the 847 units – $84,700

- In addition, the investor receives $6,564.25 annually in income from the 7.75% coupon payments. Coupon payments are made on 19 MAY and 19 NOV each year.

- By maturity in 2022, he has received $26,257.02 in coupon payments.

- This gives a total return of $110,957.02 on his investment of $100,000.

- Income received via coupon payments and

- Face Value returned at maturity.

Don’t confuse your bonds and your shares

It’s important to remember this distinction over time. When you look at your XTB holdings in your CHESS Statement or on your online broking account, although they will appear alongside your shares they will behave very differently. You hope the prices of your shares will increase over time, however you know your bonds will return to their face value of $100. But you also know that subject to a default, your bonds will pay you the coupon rate at which they were issued.

Calculate your own Cash Flow

Our Cash Flow Tool makes this really simple to understand. The tool does all the maths for you on a portfolio of up to 10 XTBs. You can even email a copy of the results to yourself or your financial adviser, so you can check how your bond investment is performing over time. Visit our Cash Flow Tool and give it a go.

A final point

The premium or discount on a bond is not the only consideration when contemplating its purchase. It’s important to consider how well the bond meets your particular financial objectives and risk tolerance. You should also consider the risks of a specific bond. Find out more about risks.

Disclaimer: The information in this article is general in nature, it does not take into account the investment objectives or circumstances of any particular investor. You should consider, with or without advice from a professional adviser, whether an investment is appropriate to your circumstances. Australian Corporate Bond Company Limited is the Securities Manager of XTBs and will earn fees in connection with an investment in XTBs.

This article was first published on XTB website here.