Life is complicated – bonds are not

(Rick Van Ness – Why Bother With Bonds, 2015)

Despite their apparent complexity, bonds are simple investments. Once you understand the simple maths underpinning the rationale for investing in bonds, you’ll understand why it makes sense to include bonds in your investment portfolio.

The first thing to remember is that a bond is a simple interest only loan, made to a government, semi-government authority or company.

The second – and important – thing to keep in mind is that with bonds, there are no surprises…bonds are predictable! (Assuming no default).

Corporate bonds are reliable and predictable

If a government or a corporate want to borrow money – whether to fund research and development, an infrastructure project, an acquisition – it has two options. It can borrow from a bank or issue bonds and borrow from investors.

While it’s well accepted that government bonds, particularly those issued by stable governments in developed nations, are reliable and predictable, investors don’t always view corporate bonds the same way.

Although there is always the risk of default – in which case the bond would be neither reliable nor predictable – avoiding the ‘junk bond’ end of the corporate bond market can considerably reduce this risk.

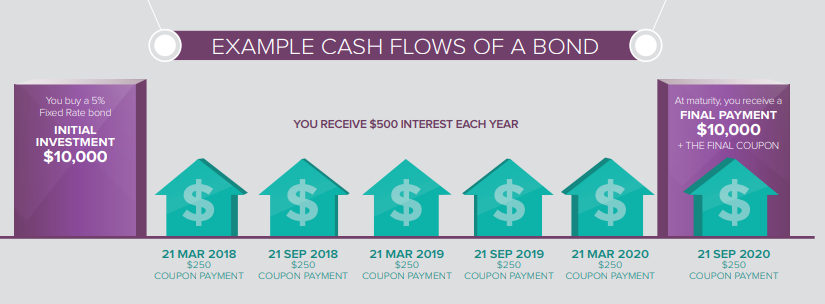

Figure one: A bond’s cashflow

Source: Australian Corporate Bond Company

Source: Australian Corporate Bond Company

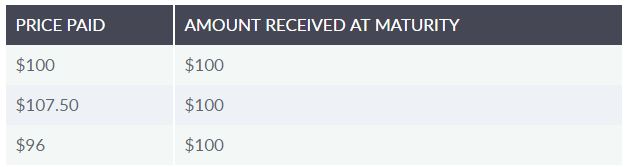

- As illustrated in figure one, when a bond matures, the loan – otherwise known as the ‘principal’ or ‘face value’ – is repaid.

- If you buy the bond at issue, you receive the same amount – the face value – at maturity.

- If you buy the bond after it’s been issued, you may pay less or more than the face value – you still receive the face value at maturity.

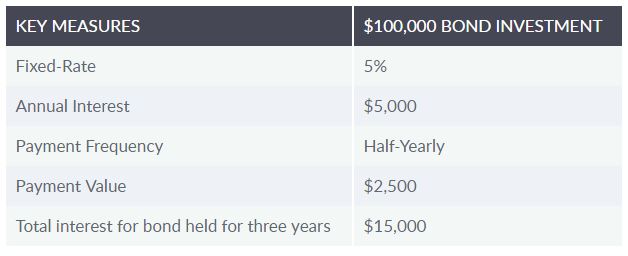

Table 1: The Maths

What’s more, you know exactly how much you will receive and when. That makes planning for fixed expenses a whole lot easier!

Table 2: The Maths (assuming an investment of $100,000)

Correlation of bonds and equities

Correlation is another mathematical concept, and one that every investor should understand.

At its simplest, the correlation of assets is a measure of whether the prices of each move together or independently from one another. Low or negative correlation means they generally move independently.

Conventional wisdom suggests an inverse relationship, or low correlation, between shares and bonds. In other words, when share prices go down, bond prices go up. While that’s a simplistic way of looking at a complex relationship, it does make sense. When sharemarkets are volatile and equity risk increases, investors flock to the relative safety of bonds.

The upside for investors with bonds in their portfolio is twofold:

- Firstly, the predictability of income and return of face value at the bond’s maturity does not change despite volatility.

- Secondly, overall portfolio returns benefit, as the positive return from bond investments can offset losses from the equity exposure.

The net effect of investing in negatively correlated assets is a smoother profile of returns for your portfolio. The large upside is reduced, but importantly, so is the large downside. This is why for many years asset allocators include a portion of both Bonds and Equities in their portfolio. It is often referred to as ‘diversification’.

The Maths – Negatively correlated assets, even one another out in a portfolio.

Bond funds and ETFs

Until recently, average parcel sizes of $500,000 made it hard for many investors to get direct access to corporate bonds. As a result, most investors have exposure to bonds via managed funds or Exchange Traded Funds (ETFs).

Investment managers offer a range of bond funds, spanning domestic and global bonds. These funds invest in an array of government and semi-government bonds, corporate bonds and high yield credit.

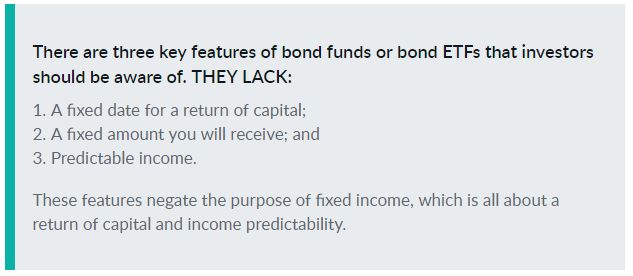

As well as being difficult to keep up-to-date with the composition of bond funds, there is one crucial factor all investors should be aware of, bond funds and ETFs are perpetual investments. Perpetual investments cannot deliver the same level of predictability that individual bonds can. It’s these predicable investment outcomes that make bonds such a reliable inclusion in your investment portfolio.

A bond fund will receive the face value when each bond in the portfolio matures, however this is generally reinvested into new bonds, not returned to investors for you to choose how to invest it.

A bond fund will receive the regular income from each bond in the portfolio, but it’s not passed through to investors. Rather, the income is distributed, adjusted for capital gains and losses, half-yearly or quarterly. You won’t know exactly how much that will be, or if losses will mean there is no income to distribute.

The chart below compares ETFs, the relative indices and a portfolio of XTBs.

IAF – iShares Core Composite Bond ETF. VAF – Vanguard Australian Fixed Interest Index EFT. VACF – Vanguard Australian Corporate Fixed Interest Index ETF

IAF – iShares Core Composite Bond ETF. VAF – Vanguard Australian Fixed Interest Index EFT. VACF – Vanguard Australian Corporate Fixed Interest Index ETF

Source: Australian Corporate Bond Company & Bloomberg*

XTBs – every day access to corporate bonds

Exchange-traded bond units – or XTBs – provide investors with easy access to corporate bonds. Through XTBs, you can benefit from the mathematical genius that is corporate bonds!

Investors receive:

- the same coupons – the regular income paid by the bond issuer, and

- the same repayment of principal – the face value of the bond paid back by the issuer when the bond matures, that they would have received had they invested directly in the bond itself.

Add to that, you can buy and sell XTBs on ASX just as you would shares in a listed company. By accessing corporate bonds through XTBs, you effectively lend money to an ASX-100 company. You can either preserve your capital by holding the XTB to maturity, or sell on ASX at any time during the life of the XTB to realise the capital.

With each XTB priced from $100 ~ $120, incorporating corporate bonds into your portfolio has never been easier. Being exchange-traded means they can be bought and sold at any time, providing you with liquidity and flexibility.

Conclusion

Exchange-traded bond units, or XTBs for short, are becoming increasingly popular due to their simplicity, affordability and convenience. Because they are traded on ASX, investors can easily monitor the value of their investment, as they do with their share portfolios. This transparency makes it easy to see that it’s maths – not magic – that makes XTBs a worthwhile addition to your investment portfolio.

*Some of the ETFs invest in bank deposit accounts, Australian Treasury, Australian semi-government entities, supranational and sovereign entities as well as Australian corporate entities, while XTBs provide exposure to Australian corporate bonds only.

Disclaimer

The information in this article is general in nature. It should not be the sole source of information. It does not take into account the investment objectives or circumstances of any particular investor. You should consider, with or without advice from a professional adviser, whether an investment is appropriate to your circumstances. Australian Corporate Bond Company Limited is the Securities Manager of XTBs and will earn fees in connection with an investment in XTBs.

This article was first published on XTB website here.