Bell Asset Management has long advocated to consider an allocation to global small and mid-cap (SMID) companies to complement and diversify existing exposure to mega and large cap companies and reduce exposure to potential crowding risk related to heightened passive flows.

Bell Asset Management has over 15 years’ experience in researching and managing global SMID companies. You can access their Global SMID strategy via the Bell Global Emerging Companies Fund available on mFund (code: BLM01).

Why Invest in Global SMID?

- Global SMID holds superior risk-adjusted return characteristics to broad global benchmarks

- Strong potential growth option - historically growth in global SMID has outpaced that in other sectors

- Lack of analyst coverage can create opportunity via exploitation of stock price inefficiencies

- Portfolio construction benefits – diversify and complement large and mega cap exposures

- ‘Sweet Spot’ – The SMID companies business cycle may show greater prospects for growth and earnings

Global SMID holds superior risk-adjusted return characteristics to broad global benchmarks

This sector has been one of the best performing global equity asset classes over 20 years. Historically, growth in Global SMID has outperformed MSCI World on a cumulative basis by +136%:

Indices | Cumulative Return |

| MSCI World SMID-ND | 276% |

| MSCI World Quality-ND | 244% |

| MSCI World-ND | 140% |

| MSCI World Growth-ND | 137% |

| MSCI World Value-ND | 132% |

Source: eVestment, in AUD and to March 2018

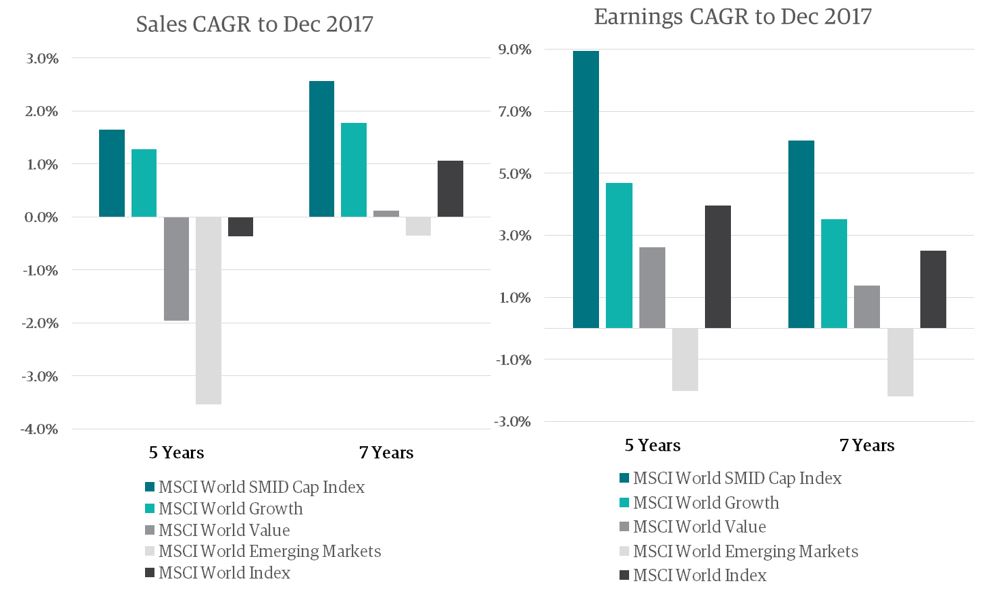

An Asset Class with Opportunity for Strong Growth

Analysis of growth in each equity bucket over the last 5 and 7 years, has shown that small and mid-cap stocks have grown sales faster than other segments. One of the key reasons for superior growth is that many SMID companies are in the sweet spot of their business cycle. The graphs below illustrate that superior growth in sales has been matched by strong earnings growth. In addition, the SMID index has also grown earnings faster than other segments.

Source: MSCI data from Bloomberg

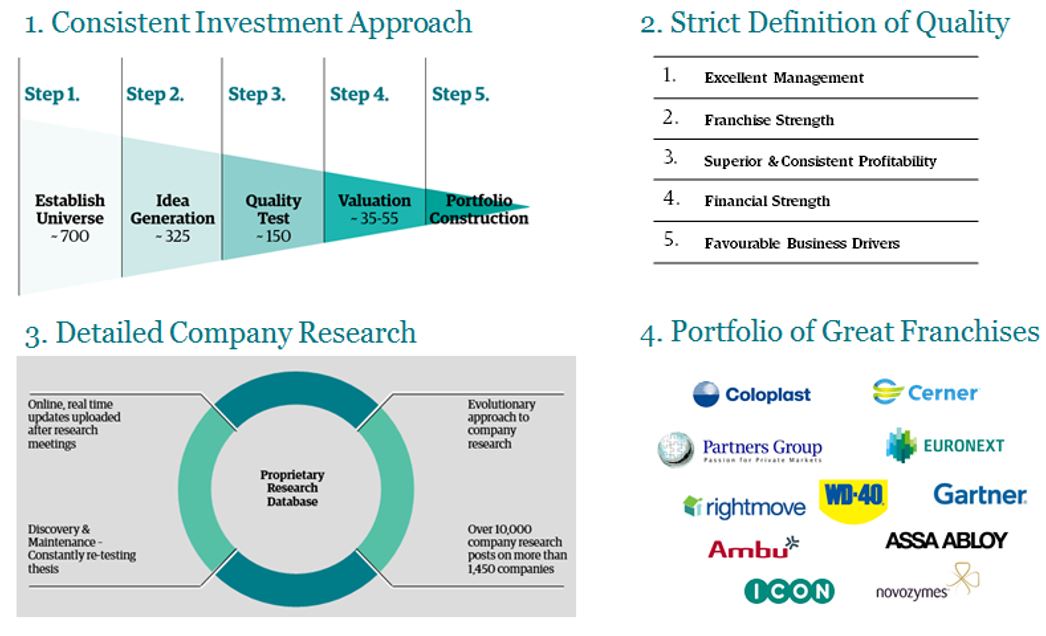

How do you find the “hidden gems” amongst global small and mid-cap companies?

Moving down the market cap spectrum to invest in global SMID companies doesn’t mean you have to compromise quality – however, a consistent investment approach is vital. Important considerations are:

- Liquidity: investing in companies with market capitalisation between US$1bn and US$28bn ensures a much better liquidity profile than a traditional small caps approach.

- Track record of high profitability: Three years of return on equity above 15%.

- High quality businesses with low levels of debt have the potential not only to provide superior risk-adjusted returns, but may also exhibit defensive characteristics in times of market volatility.

They both have durable and sustainable franchises, wide competitive moats, solid balance sheets and ample opportunity to reinvest their cash stream into high return investment opportunities. The proven track record of the respective management teams is why we believe both companies are well positioned for continued consistent earnings growth and great examples of the quality SMID cap companies we love to invest in.

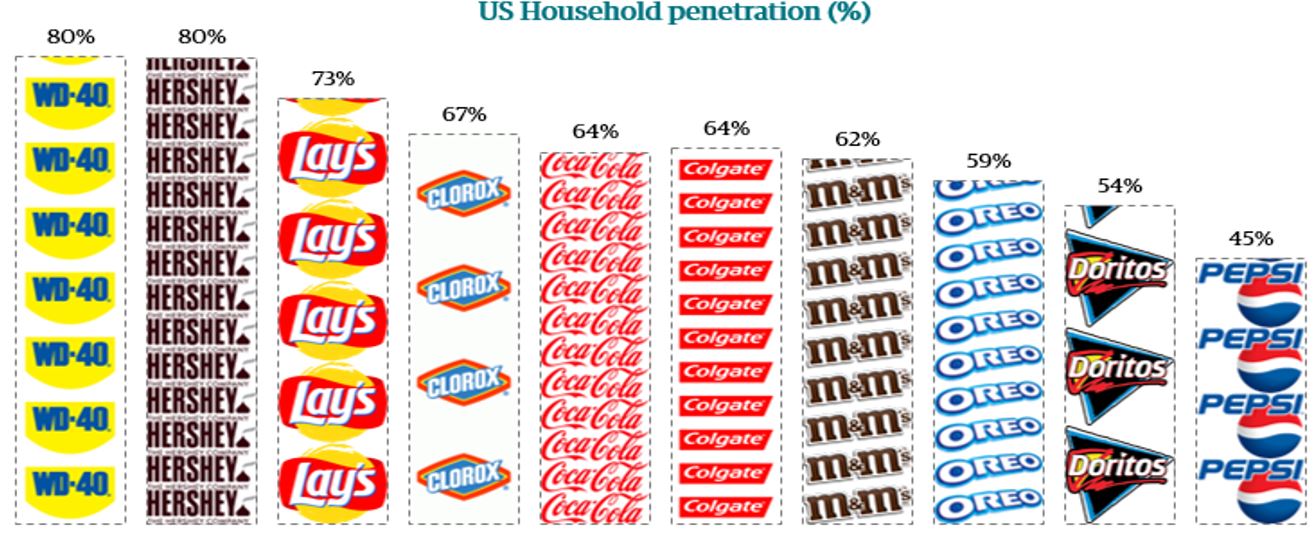

WD-40

WD-40 is a well know household name, but its initial product was developed in the 1950’s and first used to protect the metal skin of the Atlas space mission. Today WD-40 is a $1.9bn company and its flagship blue and yellow WD-40 can is found in around 80% of U.S. households and used for myriad of purposes including loosening rusted bolts, removing chewing gum from hair and shining the leaves of artificial plants.

Comparing it to other major brands, it is in more households than Lay’s chips, Coca-Cola or Colgate toothpaste. Looking at its customers from a value perspective highlights the importance of industrial customers who use around $70 of product per year in workshops, on farms and in aviation, versus household consumer use of approximately 40 cents.

Great brand, strong franchise

Much like Coca-Cola, WD-40 has myriad of patents and trademarks, but its core franchise is underpinned by keeping the base formula for the Multi-Use product an in-house company secret.

In addition, they have an intimate knowledge of their customer built through their extensive global distribution footprint. This assists in R&D and innovation which keeps WD-40 ahead of any competition. A strong brand with market leading distribution and innovation are key reasons why there is very little competition on the shelves of retailers and their product is in 80% of U.S. households.

Management

The CEO Garry Ridge is a 30 year veteran of WD-40 and has been a key driving force behind the success of the company, helping to build an accountable and high performance culture. The brand strength and impressive financial results are key reasons as to why we rate the management team very highly, their philosophy can be reconciled back to quantifiable results which we think is a key attribute when investing in SMID companies.

Is there further upside for WD-40?

At only US$1.9 billion market cap, Bell Asset Management believe that WD-40 has a long way to grow. If the company can achieve compound EPS growth of 13% p.a., then Bell Asset Management expect there is a lot more opportunity for share price upside.

Croda

Croda is a £6.1 billion world leader in manufacturing oleochemicals, which are produced from plant or animal based oils or fats. The interesting thing is that oleochemicals are in multiple products that all of us use every day including sun cream, salad dressing, fabric softener and pharmaceutical products. It is also used in industrial processes supplying speciality additives for polymer applications for scratch resistant plastic or anti-static fabrics.

Croda’s heavy focus on innovation, R&D and customer intimacy to create high value-added niche products while keeping product churn low is a key competitive advantage and why they have become a dominant player and such a great franchise.

The goal of the company is to stay on this path of growing earnings faster than revenue, hence, continue to expand margins. This trajectory is helped by structural tailwinds such trends in health and wellness, beauty and ageing, especially in emerging markets which is now around 17% of sales. Croda’s focus on naturally derived products and sustainable practices is a further advantage. Its plant and animal based oleochemicals are a replacement for existing oil based petrochemicals. Therefore, its customers striving to increase their use of sustainable ingredients are willing to pay for Croda’s innovation. It has very strong ESG characteristics and has been a member of the FTSE4Good Index since 2008.

How does this play out from a financial perspective?

The business’s first priority for cash use is capital expenditures which helps turn their R&D into revenue generating products, however, it has a much lower capital intensity than most chemical companies. Overall management are good stewards of capital, investing for growth but keeping very low levels of debt on the balance sheet.

As investors taking a long term view, the company’s multi-year track record of strong execution, positive secular trends and disciplined approach could result in continued growth in profits and good returns for shareholders.

Bell Asset Management is a leading Australian boutique investment manager specialising in global equities. The Melbourne based investment team have been managing global equities of behalf of clients for over 15 years and have a long track record of investing in global small and mid-cap companies.

Investors can access Bell Asset Management's Global SMID strategy via the Bell Global Emerging Companies Fund available on mFund (code: BLM01).

Disclaimer

Important information: This has been produced by Bell Asset Management Limited (BAM) ABN 84 092 278 647, AFSL 231091. This has been prepared by BAM for information purposes only and does not take into consideration the investment objectives, financial circumstances or needs of any particular recipient – it contains general information only. Before making any investment decision, you should consider your needs and objectives, consult with a licensed financial adviser and obtain a copy of the relevant offering document. No representation or warranty, express or implied, is made as to the accuracy, completeness or reasonableness of any assumption contained herein. To the maximum extent permitted by law, none of BAM and its directors, employees or agents accepts any liability for any loss arising, including from negligence, from the use of this document or its contents. This document shall not constitute an offer to sell or a solicitation of an offer to purchase or advice in relation to any securities within or of units in any investment fund or other investment product described herein. Any such offer shall only be made pursuant to an appropriate offer document. This presentation contains forward looking projections that are based on assumptions BAM holds as reasonable, however no guarantee or assurance is given that estimates or targets will be achieved. Past performance is not necessarily indicative of expected future performance.